The idea powering our PDF editor was to help it become as convenient as possible. You'll find the overall procedure of creating 05 359 texas comptroller stress-free as soon as you keep up with these actions.

Step 1: To begin, press the orange button "Get Form Now".

Step 2: The form editing page is now open. You can add information or update current information.

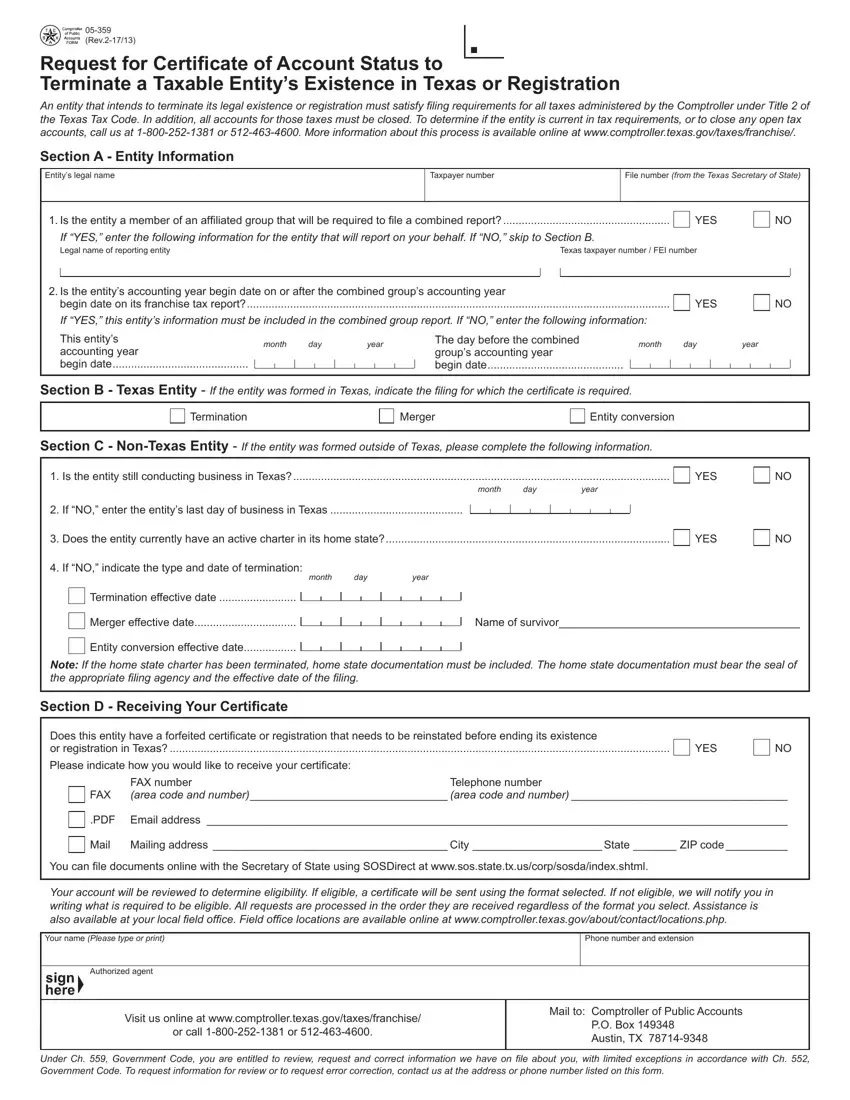

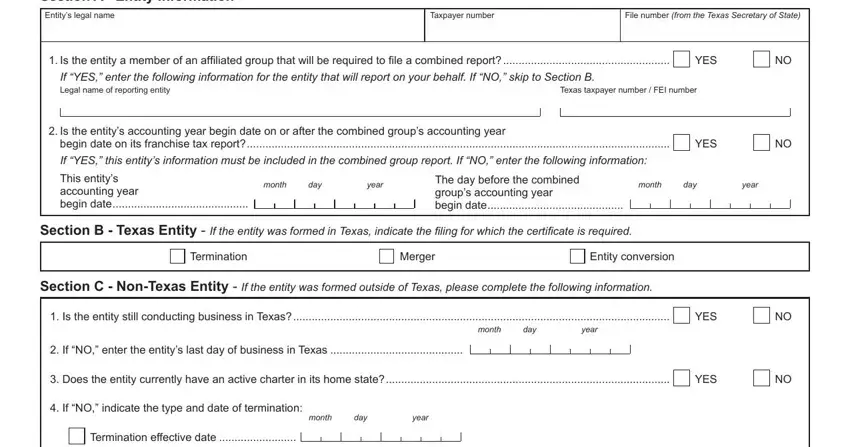

Enter the essential material in each area to complete the PDF 05 359 texas comptroller

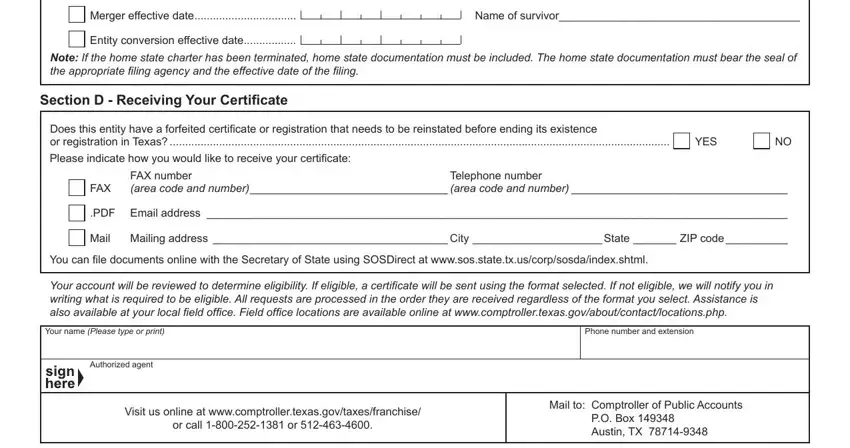

Jot down the details in the Merger effective date, Name of survivor, Entity conversion effective date, Note If the home state charter has, Section D Receiving Your, Does this entity have a forfeited, YES, FAX, FAX number area code and number, Telephone number, PDF Email address, Mail Mailing address City State, You can file documents online with, Your account will be reviewed to, and Your name Please type or print field.

Step 3: If you are done, hit the "Done" button to upload your PDF form.

Step 4: Create a duplicate of each single form. It will certainly save you time and allow you to prevent worries in the future. Also, your data isn't going to be revealed or analyzed by us.